AU Credit Card Apply: Your Trusted Partner For AU Credit Card And Easy Application Process-AU Bank stands out as a leading financial institution when it comes to banking solutions that prioritize customer satisfaction and innovation. With a wide range of services including credit cards, loans and savings accounts, AU Bank has established itself as a trusted name in the banking industry.

In this article, we will explore the benefits of the AU Credit Card and guide you through the seamless application process.

AU Credit Card Apply: Benefits

AU Credit Cards offer a wide range of benefits that meet the financial needs and lifestyle preferences of individuals. Here are some of the key benefits of the AU Credit Card:

Rewards and Rebates: AU Credit Cards come with attractive reward programs, allowing you to earn points for every transaction. These points can be redeemed for exciting gifts, discounts or even cashback, giving you added value for your spends.

Cash Withdrawal Facility: AU Credit Cards offer cash withdrawal facility from ATMs, thereby ensuring easy access to funds when needed. This feature provides flexibility and peace of mind during emergencies or while traveling.

Travel Benefits: AU Credit Cards offer a host of travel related benefits, such as airport lounge access, travel insurance coverage and discounts on flight bookings. Whether you’re a frequent traveler or planning a vacation, these amenities enhance your travel experience and save you money.

EMI Facility: With the AU Credit Card, you can convert important purchases into easy monthly instalments. This feature helps you manage your expenses effectively while enjoying the flexibility of staggered payments.

Contactless Payments: AU Credit Cards support contactless payment technology, allowing you to make quick and secure transactions with just one tap. This feature ensures a seamless shopping experience, especially in today’s fast-paced world.

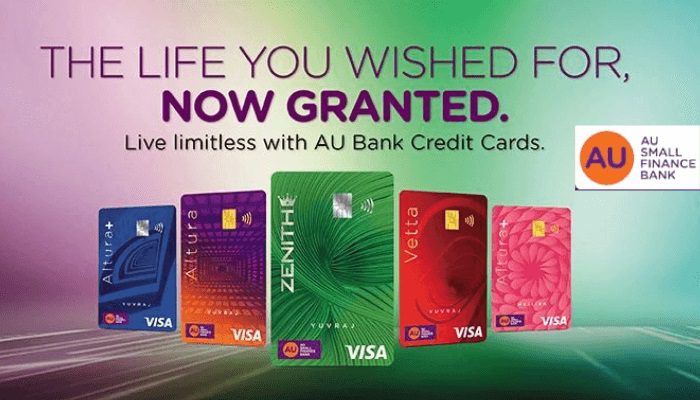

AU Credit Card Apply: Types

AU Bank offers a variety of credit cards to meet the needs of different customers. Let us go through the types of AU credit cards available:

Classic Credit Card: The Classic Credit Card is designed for individuals who are new to credit cards or prefer simplicity. It offers essential features and benefits for everyday use.

Gold Credit Card: Gold Credit Card is an upgraded version of the Classic Credit Card, which offers additional features and benefits. It appeals to individuals who want higher credit limits and enhanced rewards.

Platinum Credit Card: The Platinum Credit Card is a premium offering from AU Bank. It offers exclusive privileges, higher credit limits, enhanced rewards and a range of lifestyle benefits. This card is designed for those who enjoy luxury and premium services.

AU Credit Card Apply: Features

AU Credit Cards are equipped with features that enhance your banking experience and provide convenience. Here are some notable features:

Easy Online Application: Applying for AU Credit Card is a simple and user-friendly process. You can easily submit your application online by saving time and effort.

Low Interest Rates: AU Credit Cards offer competitive interest rates, allowing you to make purchases and repay them at affordable rates. This feature ensures that you can manage your credit card expenses effectively.

Secure Transactions: AU Credit Cards prioritize the security of your transactions. They incorporate advanced security measures and encryption protocols to keep your financial information safe, giving you peace of mind.

Flexible Payment Options: AU Credit Cards offer flexible payment options, allowing you to choose the repayment method that suits your financial situation. You can opt for minimum payment, full payment or customized repayment plan.

Online Account Management: AU Bank provides online account management

Facilities for AU Credit Cardholders. Through a secure online portal or mobile app, you can easily manage your credit card account, check your balance, review transactions, make payments and set up automatic bill payments . This feature puts you in control of your finances.

AU Credit Card Apply: Eligibility Criteria

To apply for AU Credit Card, you need to fulfill certain eligibility criteria. While specific requirements may vary depending on the type of credit card and the policies of AU Bank, here are some general factors to consider during the application process:

Age: Generally, the age of the applicants should be at least 18 years or as per the policy of the bank.

Income: AU Bank may require a minimum income to ensure that you have the financial ability to repay the credit card dues. The income criteria may differ depending on the type of credit card you are applying for.

Credit History: AU Bank evaluates the credit history of the applicant to assess his/her creditworthiness. A good credit score and a history of responsible credit behavior increase your chances of approval.

Documents: You will need to submit certain documents such as proof of identity (eg, passport, Aadhaar card), proof of address (eg, utility bill, rent agreement), and income documents (eg, salary slip, bank statement). As per the requirements of AU Bank.

Please keep in mind that meeting the eligibility criteria does not automatically guarantee approval. The final decision regarding your AU Credit Card application rests with AU Bank and is subject to their internal evaluation process.

How to apply for an AU Credit Card

Applying for an AU Credit Card is a straightforward process. Here’s a step-by-step guide:

Research: Take the time to explore the various types of AU credit cards that are available and carefully compare their features, benefits, and associated charges. This will enable you to select the credit card option that aligns perfectly with your specific financial needs and personal preferences.

Check Eligibility: Review the eligibility criteria set by AU Bank for the chosen credit card. Make sure you meet the required age, income and credit history criteria.

Documents: Gather the essential documents necessary for the credit card application process. These documents may include proof of identity, proof of address, and income-related documents. Make sure to have these documents readily available to ensure a smooth and efficient application process.

Online Application: Visit AU Bank’s website or use their mobile banking app to access the credit card application portal. Fill the required details correctly and upload the required documents.

Review and Submit: Thoroughly review all the information provided and carefully examine the application form to ensure its accuracy. Once you are confident that all the details are correct, proceed to submit the application.

Verification Process: AU Bank will review your application, verify the documents submitted and assess your eligibility. This process may take some time, and the bank may contact you for any additional information, if required.

Approval and Remittance: AU Bank will notify you if your application is approved. Your AU Credit Card will be mailed to your registered mailing address.

It is important to keep track of the application process and contact AU Bank as and when required. Once you have received your AU Credit Card, activate it according to the instructions provided, and you are ready to start using it.

Tips for choosing the right AU credit card

Consider the following factors when choosing an AU credit card:

Your financial goals: Define your financial goals and choose a credit card that suits them. For example, if you travel frequently, look for a card that offers travel-related benefits.

Interest rates and fees: Compare the interest rates, annual fees and other charges associated with various AU credit cards. Choose a card with reasonable fees and favorable interest rates.

Rewards and Benefits: Evaluate the rewards program and benefits offered by each credit card. Look for features that provide value for your spend, such as cashback offers, reward points or discounts

AU Credit Card Apply: Partner Merchant

Credit Limit: Consider the credit limit offered by AU Bank for each credit card. Make sure the limit suits your spending needs and financial capabilities.

Customer Support: Research the customer support services provided by AU Bank. It is important to choose a credit card issuer that offers reliable customer support in case of any queries or issues.

Additional Features: Look for additional features that enhance your credit card experience, such as online account management, mobile banking apps and personalized offers.

Remember to read the terms and conditions associated with each credit card carefully before making a final decision. This will help you understand the features of the card, repayment obligations and any applicable penalties.

AU Credit Card Apply: AU Credit Card Fees and Charges

AU credit cards come with some fees and charges that you should be aware of. While specific details may vary depending on the credit card chosen, here are some common charges to consider:

Annual Fee: This is the annual fee charged for holding the credit card. The amount may vary depending on the type of credit card and its features.

Interest Charges: If you carry forward the balance on your credit card, interest charges will be applicable. AU Bank charges an interest rate on the outstanding balance, and it is important to make timely payments to avoid interest accrual.

Late Payment Fee: If you fail to make the minimum payment by the due date, Late Payment Fee will be levied. Make sure you pay your credit card bill on time to avoid this charge.

Cash Advance Fee: If you withdraw cash using your AU Credit Card, a cash advance fee will apply. This fee is usually a percentage of the amount withdrawn and interest charges may also apply from the day of withdrawal.

Foreign Transaction Fee: If you use your AU Credit Card for transactions made in a foreign currency, a foreign transaction fee may be applied. It is advised to check the fees and charges associated with international transactions before using your credit card abroad.

These are some common fees and charges, but it is important to review the specific terms and conditions of your chosen AU credit card for a comprehensive understanding of the associated costs.

Managing your AU Credit Card

To maximize the benefits of your AU Credit Card, it is crucial to manage it responsibly. Here are some valuable tips for effective credit card management:

Set a budget: Set a monthly budget and make sure your credit card spending is in line with it. Avoid overspending and make it a habit to review your credit card statement regularly.

Pay on Time: Pay at least the minimum amount on time to avoid late payment charges and interest charges. Consider establishing automatic payments or setting up reminders to assist you in staying on track.

Keep an Eye on Your Statements: Keep a close eye on your credit card statements to identify any unauthorized transactions or discrepancies. Report any suspicious activity to AU Bank immediately.

Control your credit utilization: Aim to keep your credit utilization ratio (the percentage of your available credit that you’re using) under 30%. This helps in maintaining a healthy credit score.

Avoid cash advances: Minimize cash advances as much as possible, as they often attract higher interest rates and fees than regular purchases.

Update Contact Information: Notify AU Bank immediately of any change in your contact information to ensure smooth communication and timely delivery of important information.

By following these tips, you can manage your AU Credit Card effectively and enjoy its benefits without going into debt or facing unnecessary charges.

AU Bank Customer Support

AU Bank prides itself on providing excellent customer support to its credit cardholders. If you have any questions, concerns, or need assistance, you can reach AU Bank through the following channels:

Customer Care Helpline: Contact AU Bank Customer Service

Service Helpline at 1800 1200 1200 (Toll free numbers) 1800 26 66677 (Toll free numbers) for immediate assistance. Their dedicated team is available to address your queries and provide guidance regarding your AU Credit Card.

Online Help: Visit AU Bank’s website and explore their comprehensive FAQ section, which may already have answers to your questions. Additionally, you can use the online chat feature to connect with a customer support representative.

Email Support: Send an email to [email protected] to voice your concerns or seek clarification on any credit card related matter. AU Bank’s customer support team will respond to your email promptly.

AU Bank is committed to ensuring a seamless banking experience for its customers and aims to resolve any issue or concern in a timely and efficient manner.

Conclusion

AU Bank offers a range of AU Credit Cards that cater to diverse financial needs and lifestyles. With its attractive rewards, flexible payment options and superior customer service, AU Bank has established itself as a trusted name in the banking industry.

While applying for an AU Credit Card, it is essential to consider your financial goals, compare the options available and meet the eligibility criteria. By managing your credit card responsibly and being mindful of fees and charges, you can make the most of the benefits AU Bank has to offer.

Take the first step towards a rewarding banking experience by exploring AU Bank’s credit card offerings and apply today. Enjoy the convenience, security and financial flexibility offered by the AU Credit Card.

Frequently Asked Questions (FAQs)

Can I apply for AU Credit Card online?

Yes, AU Bank offers a convenient online application process for credit cards. To apply, visit their website or use their Mobile Banking App.

What documents do I need to submit for AU Credit Card application?

You will generally need to submit proof of identity, proof of address and income documents as part of the application process.

What are the credit limits offered by AU Bank for its credit cards?

The credit limit may vary depending on the type of credit card and your eligibility. AU Bank sets the credit limit based on its internal appraisal process.

How can I check the status of my credit card application?

You can track the status of your application by contacting AU Bank’s customer care helpline or through their online portal.

What should I do if my AU Credit Card is lost or stolen?

Immediately contact AU Bank’s customer care helpline to report the loss or theft of your credit card. They will guide you through the steps required to protect your account.